GLINTT is a stock-listed healthcare software company located in Portugal. This article is not meant to advise buying or selling shares in the company GLINTT. In general, the objective of this article is to explain how software healthcare companies can be valued. The author of this article does own stock in GLINTT and is planning to retain these shares for a long time to come. Each reader should do their analysis of GLINTT or any other healthcare software provider and determine its value independently.

GLINTT has started to pay dividends recently for the first time in its history. This article will argue that if the objective is to reward shareholders, a better option for GLINTT is to repurchase its shares.

Healthcare software companies deliver software for the healthcare industry. GLINTT provides software for hospitals. Besides this, it is also a major player in software for pharmacies both in its home market in Portugal as well as in Spain. In this article, we will assess the valuation of GLINTT by offering insights into topics like:

- Valuations in the healthcare software industry

- Valuation of GLINTT on a group level

- Valuation of GLINTT based on the individual parts of its business (including healthcare software)

- Enterprise value versus equity value: GLINTT’s 40 million euros in debt

- What determines the price of a healthcare software company?

- Dividend payments and the influence of the value on a healthcare software company

- Questions on the value of a healthcare software company

Valuations in the healthcare software industry

Software companies are normally highly valued given that they support critical parts of their clients’ activities. This is even more the case for the healthcare industry where human health is extremely important. Digitization is becoming more essential within this field because it enables software companies to grow the quality of their services offered to clients. EBITDA multiples for smaller, mature, private software companies can be very broad. Simply stated, let’s say an EBITDA multiple ranges from 7 to 10 or even more.

For stock-listed software companies, this can differ. Most listed software companies trade at higher EBITDA multiples as they have less risk compared to their private software counterparts and can be more easily exchanged into cash when this is required. Constellation is a listed software company that owns a large portfolio of smaller software companies across various industries. Constellation is often trading at an EBITDA multiple of more than 25. Constellation acquires new software companies regularly and is considered one of the best companies in the market, but still, this is a high multiple. GLINTT is often trading at a multiple of around 4 times the EBITDA. Of course, this comparison of EBITDA multiples is not fully like-for-like as GLINTT does sell services and hardware next to its software. Further, Portugal’s stock market is different than the Toronto stock exchange. However, is the difference in EBITDA multiples between both companies somehow remarkable?

Valuation of GLINTT on a group level

On another level, I want to keep things very simple and calculate with high-level numbers only. Let’s assume that GLINTT has 100 million euros in revenue (as of the date of this article it is already more). For a company with significant software activity, it should be possible to achieve a 20% EBITDA margin and hence a 20 million euro EBITDA. However, GLINNT has various activities, some of which are not as lucrative as software.

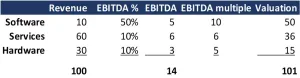

The way GLINTT reports revenue does not give much clarity on the actual split of revenue and is, in my opinion, somewhat old-fashioned. It only reports services and ‘Vendas’ which is hardware, if I understand it correctly. For simplicity, in the table below I assume services, which include healthcare and pharma software are responsible for 70% of GLINTT’s revenue and hardware is the remaining 30%.

Which EBITDA multiples can we assign to the various activities?

10 times the EBITDA for software: Healthcare and pharma software, especially of the quality and position that GLINTT possesses should at least be rewarded 10 times the EBITDA multiple.

6 times the EBITDA for services: For a stock-listed company like GLINTT, services should get rewarded more than 6 times, but for this exercise let’s calculate with 6.

5 times the EBITDA for hardware: Hardware sales are normally considered of a lower value. However, consider that GLINTT distributes hardware like robotics. Further, the hardware it sells is within a long-term client base of pharmacies where it has a strong position.

An important question is, which part of the revenue is related to pure software? This is not reported by GLINTT separately. Hence, I have assumed it to be 10 million euros in the table below. However, in reality, I think it could be higher.

In practice, GLINTT’s EBITDA is already much higher than 14 million euros and could be more towards 18 to 20 million euros. Also, revenue is likely higher than the 100 million euros above. To keep it simple, I have left them as is.

GLINTT, from my point of view, deserves an EBITDA multiple of around 7. This is because GLINTT has a strong position in pharma and healthcare, and it is dominant in its home market in Portugal. In addition, it is also growing in Spain. Its EBITDA is currently growing towards 20 million euros. However, based on the revenue allocation in the table above, I am assuming an EBITDA of more than 14 million euros. With an EBITDA multiple of 7, an enterprise value of 100 million euros seems realistic to me.

For a detailed calculation of the value of your own IT company please visit: click here

Valuation of GLINTT based on the individual parts of its business (including healthcare software)

GLINTT has various activities:

a) It is a service provider of software to pharmaceutical companies in Portugal and Spain

b) It provides software for hospitals, mainly in Portugal but gradually more in Spain too if I am correct

c) Nexllence is a digitalization agency with around 300 people and plans for growth

d) Support for new developments in healthcare and other smaller activities like Odontonet

In the past, I analyzed all the publicly available financial details on the legal entities and activities of GLINTT. I have attempted to reconcile the available statutory accounts with the published consolidated group numbers. This reconciliation did not fully work out, probably because some overhead costs were not incorporated in the analyzed statutory legal entities. Further, In the meantime, I think GLINTT has stopped activities in most foreign markets such as Angola, Brazil, Ireland, Poland, and the UK. The two primary remaining markets seem to be Portugal and Spain.

In the field of software for pharmacies, it is possible to get some idea of a valuation.

In Spain, GLINTT owns Consoft which is a pharmacy software provider with around 8 million euros in revenue and a 50% EBITDA margin. Based on a 4 million EBITDA and 10 times the EBITDA multiple (remember Constellation is trading at 26 times) Consoft could have an enterprise value of 40 million euros.

It is difficult to assess the number of pharmacies GLINTT services in Spain, but it could be up to 13,000 pharmacies. Somewhere in my old notes, I found that GLINTT services around 16,000 pharmacies in total.

At the same time, GLINTT is a market leader in its home market in Portugal where it provides similar software for pharmacies. I understand that GLINTT services around 2,800 pharmacies in Portugal. This part should also have an interesting value. Would someone know the actual number of pharmacies served in both countries? This would be helpful.

The value of the software for hospitals is difficult to assess as limited numbers for this healthcare software activity are available. Based on the number of hospitals, 200, that GLINTT is servicing this activity certainly has an attractive value. It is not fully clear if the financials of this healthcare software activity are the Portuguese legal entity Glintt – Business Solutions, LDA. This legal entity posted 36 million euros in revenue and an EBITDA number of 4 million the last time I analyzed it.

Nexllence is an IT consultancy that services clients across various industries. Nexllence has no single separate legal entity in the GLINTT accounts, as far as I can see. Digitalization, the field where it operates, is a growing activity across all industries. With around 300 people, the total revenue is estimated to be around 25 million euros. For a consultancy and software development service provider, we can assume a 10% EBITDA margin resulting in an EBITDA of 2,5 million euros. Assigning a relatively modest multiple of 6, Nexllence could have a value of at least 15 million euros. GLINTT’s management plans to grow Nexllence to 42 million euros in revenue in 2027, with a team of 350 people.

Support for new developments in healthcare and other smaller activities like Odontonet also has value. GLINTT is quite actively promoting and supporting new digital innovations for the Portuguese and Spanish healthcare industries. This is important given the aging population in both countries. However, to keep things simple, be conservative and do not assign a value to this activity yet. The same would apply to Odontonet software for the Spanish dental industry which is still relatively small but has potential to grow.

Altogether, the analysis of the separate individual parts does not give a satisfactory outcome. It does not provide detailed numbers that give a good insight into the value of the separate activities of the company. However, it gives some flavor that these activities provide good value and have an appealing position in the market.

Enterprise value versus equity value: GLINTT’s 40 million euros in debt

GLINTT still has high debt. In the past, I calculated it to be around 40 million euros. GLINTT seems to repay on an annual basis, so I expect the current actual debt to be lower. However, for simplicity, I want to leave the amount at 40 million euros. This is because we want to deal with the concept of enterprise and equity value in this paragraph. Enterprise value and equity value are two important concepts in a company valuation, and they provide different perspectives on the worth of a business. I want to start again with their definitions:

Enterprise value (EV): Enterprise value represents the total value of a company’s operations including free cash and debt. It is calculated by adding a company’s market capitalization (equity value) to its debt and subtracting any cash and cash equivalents.

Enterprise value = market capitalization + debt – cash and cash equivalents: Enterprise value considers not only the value of a company’s equity but also its debt and cash holdings. It reflects the value of the entire enterprise, including both the interests of equity shareholders and debt holders.

Equity value: Equity value, also known as market capitalization or market value of equity, represents the value of a company’s shareholders’ equity. It is calculated by multiplying the company’s share price by the number of outstanding shares.

Equity value = share price * number of outstanding shares: Equity value reflects the ownership interest of shareholders in a company and represents the residual claim on assets after deducting liabilities. It does not consider debt or cash in its calculation.

Now, l want to discuss how these values impact GLINTT’s valuation:

The enterprise value we have seen in the paragraphs above could be as high as 100 million euros. We want to calculate with simple numbers just to show the purpose of the calculation.

From the above, we know that the estimated debt is 40 million euros. Also, working capital has not been analyzed. Given it is not the scope of this article not, we can assume GLINTT has sufficient working capital.

From the above theoretical calculations, we can now see that the equity value of GLINTT could be as high as 60 million euros (100 million euros in enterprise value minus the net debt of 40 million euros). Based on the current market value of the shares, and the analysis done in this article, you can make your conclusions.

What determines the price of a healthcare software company (for example GLINTT)

Valuing a healthcare software company like GLINTT involves both technical and subjective elements. Each person will have a different view. Currently, the equity value of GLINTT is considered to be around 25 million euros based on its stock price.

Market share: GLINTT has a large market share in its home market in Portugal with software for pharmacies. In Spain, it seems that GLINTT is gradually growing its market share and winning new pharmacies as clients. A large market share often makes companies more valuable than those with smaller ones due to their stronger competitive positions and greater pricing power.

Customer base: The customer base of GLINTT is stable as pharmacies do not tend to change their software provider regularly. This is an essential factor that determines the value of a healthcare or pharmacy software company. A large customer base can bring many advantages to a healthcare or pharmacy software company, including:

- Revenue stability: Massive changes or clients dropping off is low and given the larger client size revenue numbers tend to be predictable. Stable and predictable revenue streams should appeal to investors.

- Pricing power: Companies with a large customer base often possess pricing power. The question is how relevant this is for GLINTT. Many of its shareholders are also their clients (the pharmacy owners in Portugal)

- Growth potential: GLINTT can still expand much further in Spain with pharmacy software. Further, its healthcare software can be supplied to more companies such as hospitals. Expansion in new markets like the dental clinic software market is also an option.

Product portfolio: Healthcare software companies have good valuations. For GLINTT, software is the most valuable part, but it also needs to provide services and hardware to its pharmacy client base.

Management team: One key factor determining a company’s value is its leadership team. For me, it is difficult to assess the quality of GLINTT’s management team. What do you think? Please leave your opinion at the end of the article.

For a more detailed analysis of enterprise value versus equity value please read more here: Click here for our blog article on enterprise value versus equity value

Dividend payments and the influence of the value on a healthcare software company

Recently, GLINTT has started to pay dividends for the first time in its history. As of June 2023, GLINTT distributed dividends intending to reward shareholders. The question is if distributing dividends is in the best interest of shareholders of a healthcare software company like GLINTT. Dividends are taxed in Portugal at 35%. A better option for GLINTT is possibly to repurchase its shares. With the potential amount of 1,5 million euros that GLINTT devoted to dividends, at the current share price, 5 to 6 million shares could be repurchased.

Repurchasing their shares would have given current shareholders that want to exit the business the opportunity to sell their shares which would increase the share price. This higher value would enable shareholders that want some cash now to sell off some of their shares. This would give shareholders cash too, but without dividend taxes to be paid. What do you think is the best strategy for GLINTT, to pay dividends or repurchase its shares?

Disclaimer: This article is not meant to advise anyone to buy or sell shares in the company GLINTT. CFIE is active in supporting the buying and selling of companies. It does not give advice on buying or selling shares in stock-listed companies. This article on GLINTT has only been written to give an example of how a healthcare software company can be valued.

Questions on the value of a healthcare software company?

What do you think is the correct way to value a healthcare software company?

What do you think about the current valuation of GLINTT?

Do you have any feedback or remarks that might have an impact on the valuation of this healthcare software company GLINTT?