Chemical distribution companies are responsible for storing, transporting, and delivering chemicals from manufacturers to end users. In this article, we will assess their valuation while offering insights into topics like:

- Developments in the chemical distribution industry

- Value and price expectations of business owners in the chemical distribution industry

- What determines the price of a chemical distribution company when you sell?

- Influencing factors and valuation multiples for chemical distribution companies

- Trends within the chemical distribution industry

Developments in the chemical distribution industry

Chemical distribution companies typically fall into two main categories: commodity chemical distributors and specialty chemical distributors. Commodity chemical distributors specialize in bulk chemicals like fertilizers, solvents, and fuels while specialty distributors focus on more complex chemicals to a larger degree, for industries like pharmaceuticals, personal care, and electronics.

Over recent years, there has been a significant expansion in the chemical distribution industry driven by rising demand across various sectors for chemicals. Digitization is also becoming more prominent within this field. Increasingly, companies are utilizing technology to optimize logistics, storage, and delivery processes. Furthermore, more eco-friendly practices and sustainable alternatives to traditional chemicals have become prevalent among companies operating within this space.

Chemical distribution industry consolidation and the rising involvement of private equity funds have driven company prices higher in recent years, prompting many owners to believe they can obtain high EBITDA multiples, such as ten times or more significant, for their companies.

Chemical distribution company owners often demand an inflated price, while buyers needing more funds for acquisitions, staff salaries, or software licenses to increase the value of the acquired chemical distributor may offer less. This results in a bidding war where chemical distributor owners seek a premium while buyers offer less.

Value and price expectations of business owners in the chemical distribution industry

Business owners in the chemical distribution market want to understand how much their enterprise is worth, yet calculating this value may be challenging due to numerous variables that could sway its estimation. Note that prices and values of chemical distribution companies from the owners’ perspective often differ significantly from what buyers offer. Further, financial buyers like private equity funds, family offices, or holding corporations typically offer lower prices than strategic buyers such as chemical manufacturers or more prominent distributors. Entrepreneurs may want to seek professional assistance from accounting firms or business brokers in calculating an appropriate valuation of their enterprise.

What determines the price of a chemical distribution company when you sell?

Valuing a chemical distribution company involves both technical and subjective elements. While technical valuation involves analyzing financial statements and other quantitative data, subjective valuation involves evaluating your company’s competitive position. This includes clients, services, and locations as well as market trends and qualitative aspects such as client relations or market research trends. Moreover, professional assistance from M&A consultants will enable you to arrive at an accurate value for your enterprise.

Market Share: Large market share often makes companies more valuable than those with smaller reach due to their stronger competitive positions and greater pricing power that led to greater revenues and profits. On the other hand, having a larger market share does not always translate to higher valuations. Especially, when operating in highly saturated or saturated markets compared to those with greater growth potential, such as rapidly developing ones with reduced competition for customers.

Customer Base: The customer base is an essential factor that determines the value of a chemical distribution company. Companies with large and diverse customer bases tend to be considered more valuable since more customers provide increased stable revenue streams as well as providing room for future expansion. An expansive customer base can bring many advantages to a chemical distribution company, including:

- Revenue Stability: Establishing an expansive customer base can help protect a business from changes in demand from any one customer or market sector, providing more stable and predictable revenue streams that appeal to investors.

- Pricing Power: Companies with a diverse customer base often possess greater pricing power, as they rely less heavily on individual clients or market sectors for their revenue stream. This can increase profitability and margins while increasing the valuation of the company.

- Growth Potential: Chemical distribution companies that rely heavily on customers have more potential for expansion as a larger and diversified customer base enables the business to enter new markets or create products tailored specifically for specific customer requirements.

Product Portfolio: Chemical distribution companies that deal in commodity chemicals may experience more drastic fluctuations due to their fluctuating price, while specialty chemical suppliers could command higher prices due to their unique properties.

Industry Trends: Current industry trends such as sustainability and digital transformation may significantly affect the value of chemical distribution businesses. Companies positioned to take advantage of such initiatives may prove more lucrative than those that miss these opportunities.

Reputation: Brand reputation can have an enormous impact on a company’s value. Especially, those with stronger names and positive associations which tend to be seen as more valuable than ones with lesser well-known names or unfavorable associations.

Management Team: One key factor determining a company’s value is its leadership team. Businesses with experienced management are usually considered more valuable than those led by inexperienced or weak leaders.

Influencing factors and valuation multiples

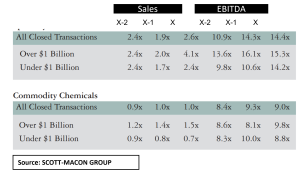

Chemical distribution company values can be determined by several factors, including its financial performance, customer base size, geographical reach, and product mix. Macroeconomic conditions, industry regulations, and technological advancements may also affect their value. Valuation multiples in the chemical distribution market generally range from 6 to 10 times the EBITDA. However, this may vary based on various factors, including the size of the company, the industry it operates in, and the motivations behind the acquisition. The bigger the company, the more EBITDA multiples it can achieve.

Commodity chemical distributors typically deal in high-volume, low-margin products with wide availability and few barriers to entry. Competition in this market tends to be fierce while profit margins can remain relatively low, leading to lower valuations than specialty chemical distributors, who tend to specialize in products requiring specialized knowledge or expertise for production and distribution. Competition may be lower and barriers more formidable in this arena, leading to greater profit margins and thus higher valuations overall.

Innovative companies often drive demand for specialty chemicals, leading to a competitive advantage for specialty chemical distributors who have expertise in these areas compared to commodity chemical distributors who may offer commodity chemicals only. As such, valuations may be higher for specialty chemical distributors.

Overall, the difference in valuation between commodity chemical distributors and specialty chemical distributors can be explained by several factors including product type, competition, profit margins, barriers to entry, and so forth.

Trends within the chemical distribution industry

Consolidation: The chemical distribution industry has experienced an ongoing consolidation trend as larger companies acquire smaller ones to increase efficiency and market share. This trend can be explained by many factors including cost savings and new market entry opportunities. Ultimately, this leads to industry consolidation with only a handful of major players dominating it all. Consolidation also allows businesses to invest heavily in the research and development of products to remain competitive in an ever-evolving marketplace.

Sustainable Practices: Over recent years, Chemical distributors have witnessed an upsurge in eco-friendly practices due to growing environmental awareness and emphasis on cutting carbon emissions and waste production. Businesses have taken steps to minimize their carbon footprint by investing in renewable energy or decreasing packaging waste plus, they have placed increased importance on creating eco-friendly alternatives to traditional chemical products.

Digital Transformations: Technology is quickly revolutionizing the chemical distribution industry, with companies increasingly using digital platforms to increase efficiency, provide superior customer service, and gain real-time insight into their operations. Solutions like cloud computing, data analytics, and machine learning are being adopted to optimize supply chain processes and enhance overall operations. This means more customers are ordering chemicals online via e-commerce platforms that offer doorstep delivery directly.

Use our online valuation tool to get an estimate for your chemical distribution business

Are you uncertain of the worth of your chemical distribution business? Try our valuation tool. It is fast and simple. Just enter basic business information to get started. You can find our chemical company valuation tool here: Click here for the CFIE valuation tool.

Your opinion matter to us!

What is your opinion, please let us know your thoughts?

Disclaimer

The industry valuation calculators are designed to help you get a rough idea of your business value, but are not intended to be used as a substitute for professional advice. It is not intended to be used in the context of a sale or other transaction. It is only guidance for business owners or users. In case you want a more detailed and further fine-tuned valuation for your company please contact the CFIE team.

Valuation of chemical distribution companies will go down now that interest rates are high.

We will be selling a good distributor. Please reach out in case you are interested.